The statement page is usually the extremely initial page of the package you will receive from your insurer. It should be plainly labeled as the "statements web page" or "your policy declarations." Commonly, you do not need to wait on a paper copy of your plan to show up in the mail (liability).

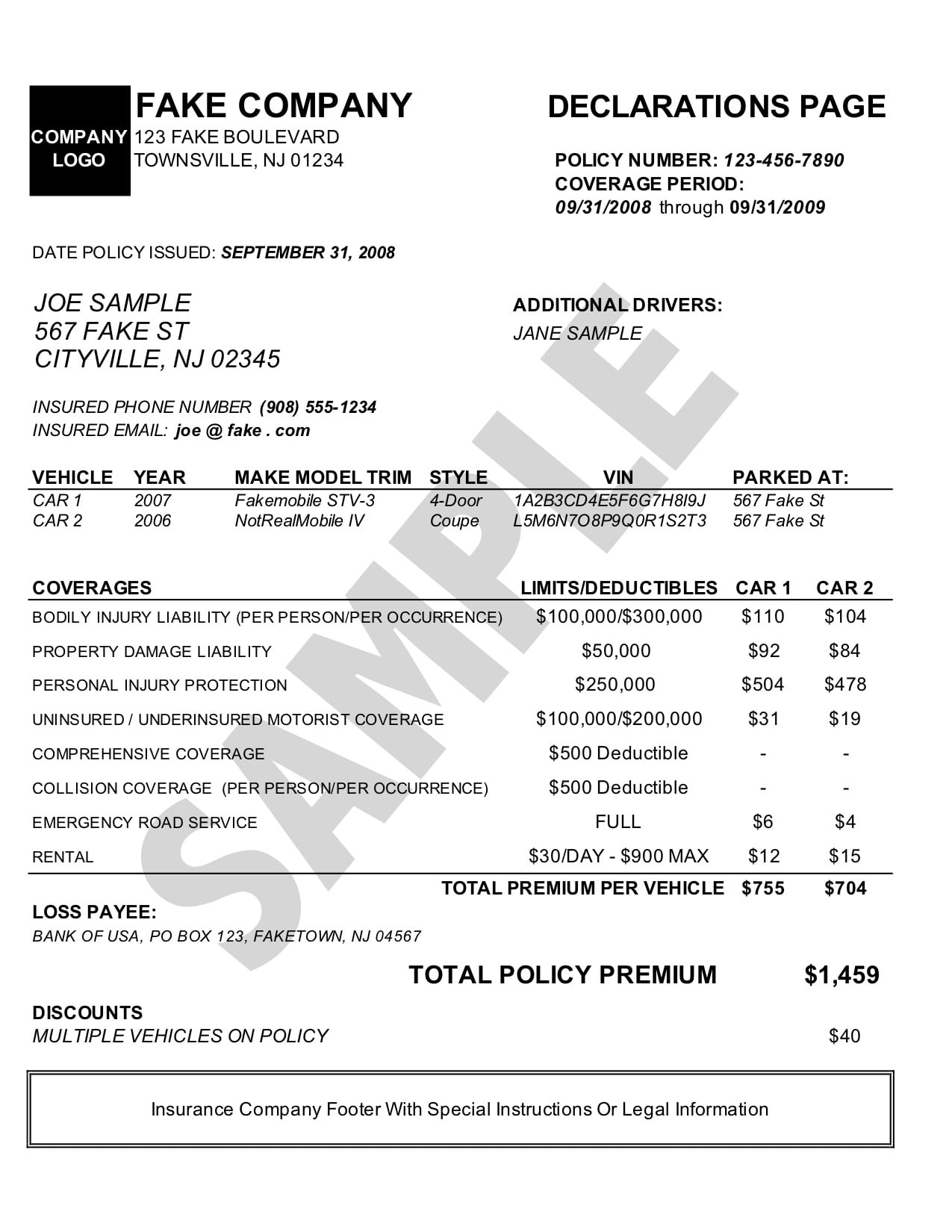

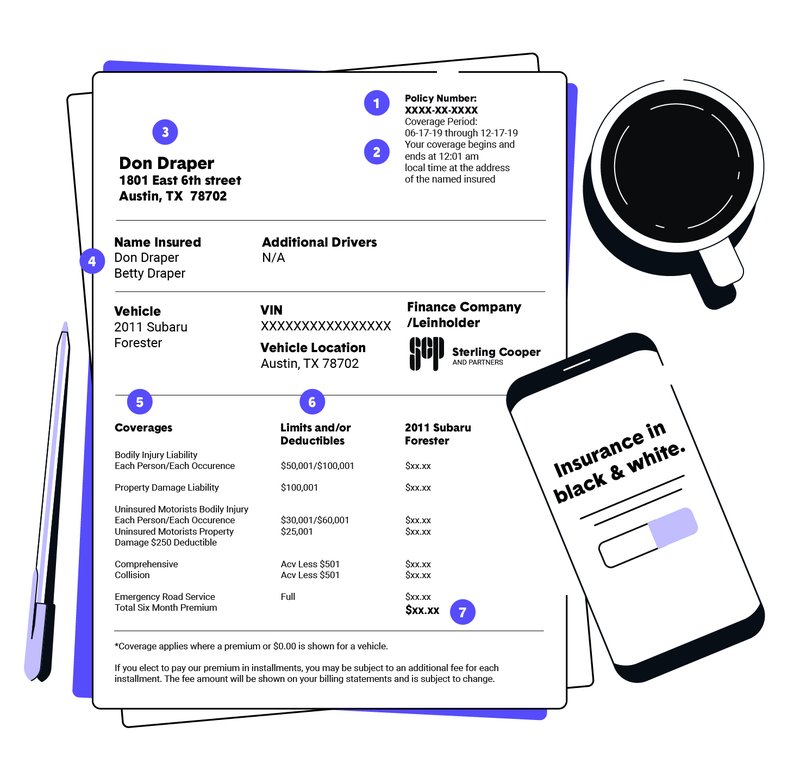

What gets on the Car Insurance Declaration Web Page? The length of the affirmation web page section of an insurance provider's auto plan might run, confusingly enough, to even more than a web page. Be sure to read it fully. auto insurance. Info that is included in an automobile insurance statement page includes: Your policy number as well as call details, i.

Names of all the drivers who are insured as well as covered under the plan - insurance company. The cars covered under the plan and also their automobile recognition numbers (VIN). A checklist or schedule of coverage, restrictions, deductibles, and the price for each sort of coverage. This will certainly be additional broken down by automobile if you have actually a number of cars noted under your policy.

cheaper auto insurance money risks money

cheaper auto insurance money risks money

The days the plan is in result. insured car. Any type of price cuts that have been related to the policy. Any surcharges such as current insurance claims or web traffic tickets. These will essentially contribute to the cost of your plan. Be sure to assess the affirmations web page after you restore or make any changes to your vehicle insurance coverage.

Some Known Facts About How To Understand Your Auto Insurance Declaration Page.

Ask that they send you a fresh declarations web page. It is imperative to carefully check out and also assess this page after each revival and also adjustment, to verify all the info is precise. Here are the critical elements of the declaration page that require your focus: Plan Number You'll find this important number at the top of the page - car.

Provided Drivers This is essential information that can be discovered on top of the web page. This part will detail the names and also addresses of everyone that is covered under the policy. If you later realize you require to add individuals to this list, you can do so by calling the insurance provider. auto insurance.

Covered Automobiles Also, in the statement page, you'll locate the make as well as version of the lorries you are insuring along with their VIN or serial numbers. This is an incredibly vital part of a cars and truck insurance policy affirmation web page - car insurance. When you read the web page, you need to make certain that this details is exact.

For example, if you are financing or renting an auto through a dealer, they need to be detailed on the vehicle insurance statement web page. This is crucial details that is simple to miss out on. Costs Total Amount Beside each car, you need to see a total costs for the plan period. If you have more than one vehicle covered under your insurance coverage plan, these total amounts will be listed in addition to any kind of charges included showing the complete plan costs.

Kinds of Coverage Your affirmation page will certainly likewise show each kind of coverage you have actually picked. accident. The protection will certainly be noted independently with liability restrictions and break downs of what your premiums are for each kind - car. Deductibles An insurance deductible is the amount you are in charge of paying prior to your insurance can kick in and also cover expenses.

Rumored Buzz on Decipher Car Insurance Terms & Definitions

If you purchased crash insurance coverage with a $250 insurance deductible, you should pay that amount prior to insurance coverage covers the rest. On your statement page, you'll see just how much you chose to pay as insurance deductible for each kind of insurance coverage. You can choose to alter that quantity any time.

perks auto insurance cheap car insurance insurance companies

perks auto insurance cheap car insurance insurance companies

All your discounts must be detailed on the statement web page. Appropriate Insurance Coverage Levels One of the most essential facets of cars and truck insurance coverage is making certain to choose the kind of insurance coverage that is right for you and also your family members.

perks cheaper cars cheaper car insurance prices

perks cheaper cars cheaper car insurance prices

low cost auto liability dui risks

low cost auto liability dui risks

To make this decision, you need to understand Click here for info the different sorts of insurance coverage and what is advised (cheapest car). Liability Protection This essentially covers clinical expenses, vehicle fixings and various other prices that arise from injuries or damage that you or a chauffeur named in your plan causes to somebody else. Responsibility insurance policy is what safeguards you when you are driving someone else's vehicle with his or her permission (cheap car).

Vehicle drivers in The golden state are called for under the regulation to have minimal obligation insurance policy protection of $15,000 for injury/death to one individual, and also $30,000 for injury/death to greater than one person. Crash Insurance coverage This kind of insurance coverage spends for any type of damages your car has actually sustained as the result of colliding with one more car or item.

Deductibles for this sort of coverage array from $250 to $1,000. money. Frequently, a lower insurance deductible indicates a greater premium and a greater insurance deductible lead to a lower premium - cheap auto insurance. Comprehensive Protection This type of insurance coverage will essentially pay for any kind of damages to your car that is brought on by something various other than a cars and truck mishap.

A Biased View of What Is An Insurance Declaration Page? - Hourly, Inc.

Your cars and truck insurance statement web page should specify if you have actually chosen not to purchase this insurance coverage. It is vital to comprehend that while obligation insurance policy safeguards others who are struck by you, the without insurance and underinsured driver clause is the one that might in fact secure and compensate you and also your household in several scenarios. trucks.